Rethinking Cloud Finance: How Cloud Capital Removes Commitment Risk

How Cloud Capital manages commitments differently

TL'DR

- AWS is ending the era of flexible commitments, leaving CFOs exposed to multi-year financial risk.

- Cloud Capital underwrites the risk of AWS commitments so you don’t have to,

- You access long-term savings while staying flexible – no penalties if your usage changes.

- The model aligns with AWS’s goals without relying on unsustainable workarounds or loopholes.

- It’s a finance-first approach that turns cloud spend into a structured, manageable asset – not a liability.

If you’ve been reading this series, you already know the party is over.

The loopholes are closing. The tricks are ending. AWS is done letting customers dance around cloud commitments without consequence.

And CFOs must act now, especially those at high-growth or venture-backed companies. It’s a financial reality check. Because when long-term cloud obligations stop being flexible, they start feeling a lot like debt.

So now what?

You’re under pressure to cut burn. Extend runway. Hit gross margin targets. And yet, your engineering team needs to move fast, scale aggressively, and keep cloud costs under control.

Until now, you’ve been able to walk that tightrope because the system let you. There was always a back door. Vendors could “optimize” your way out of risk. Reserved Instances could be flipped. Commitments could be group-purchased, pooled, reassigned, or quietly returned.

But with AWS enforcing new discipline, the safety net disappears, and suddenly, that massive cloud commitment line item feels heavier than ever.

Here’s the problem: cloud finance wasn’t built for this moment. And you’re the one left trying to clean up the mess.

Cloud commitments don’t behave like traditional finance tools. But they should.

Right now, most cloud providers ask you to forecast your infrastructure needs three years into the future. In startup terms, that’s an eternity.

Then they ask you to absorb 100% of the risk on your balance sheet, no protection, no flexibility, just so you can access the pricing they want you to use. That’s like asking a CFO to sign a 36-month lease on office space without any exit clause, sublease rights, or visibility into next quarter’s headcount.

It’s not just unfair, it’s financially incoherent. And yet, this is how cloud finance still works today. You’re expected to:

- Commit to multi-year spend levels, even though your company might pivot next quarter

- Lock in infrastructure usage patterns as if your roadmap won’t change

- Carry full downside risk on commitments, while usage behaves more like a commodity

- And somehow, align this with volatile revenue projections and investor expectations

No other major corporate expense behaves this way. It's time cloud finance caught up with basic financial standards.

No CFO in any other domain would agree to these terms. If this were energy or raw materials, the risk would be hedged, priced, and distributed. But cloud? It’s every finance leader for themselves. That needs to change.

We need a cloud model built on financial first principles

Imagine you’re buying electricity. You might lock in a rate, sure, but you'd expect the ability to shift usage as needed. You’d expect someone else, usually a financial intermediary, to carry the risk of market volatility.

Cloud should work the same way. You shouldn’t have to guess what your infrastructure usage will be three years from now. You shouldn’t be punished for using less than you planned, or penalized when your business shifts. Instead, you should be able to:

- Access the best pricing available

- Stay flexible as your company grows and changes

- Only pay for what you use

- Transfer risk to someone built to manage it

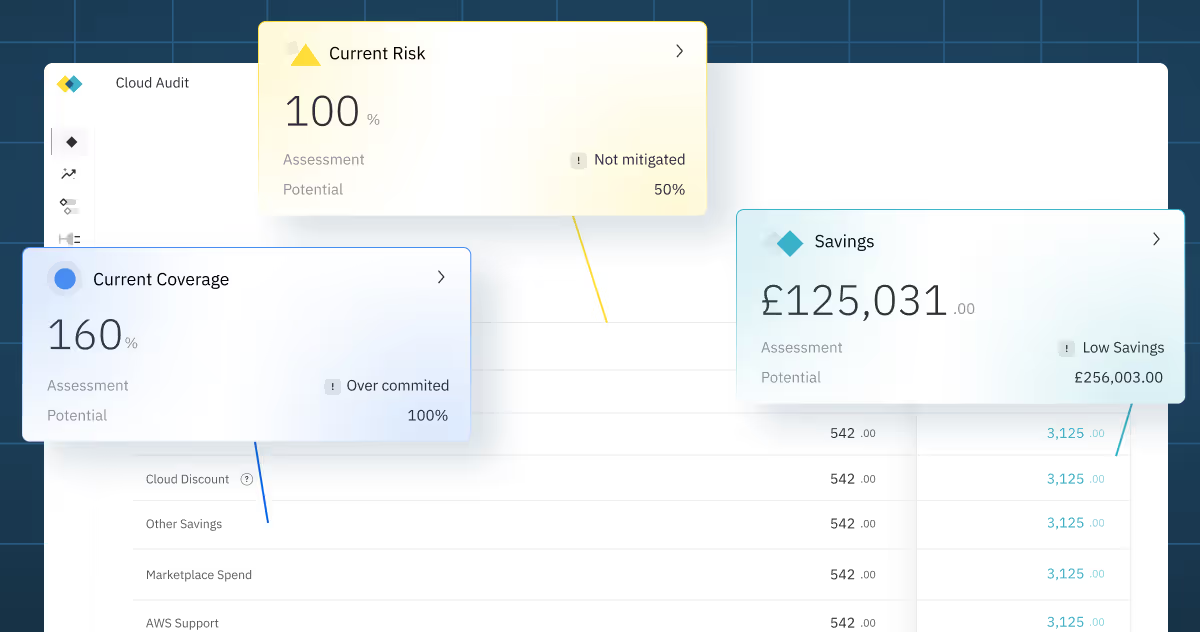

Cloud Capital was built around these exact first principles - to turn cloud spend into a controllable, finance-grade asset. That’s where Cloud Capital comes in.

What we believe

At Cloud Capital, we don’t think cloud spending should be a gamble. We think it should behave like a real financial instrument, something that can be structured, priced, and managed intelligently.

That means rethinking the entire model from the ground up. Not just offering “better optimization.” Not just reselling AWS at a margin.

It means creating a platform that treats cloud commitment risk as a solvable financial problem, not a burden to be shoved onto startups.

So here’s what we do differently

- We take on the risk, so you don’t have to: When you make a commitment through Cloud Capital, we’re the ones who underwrite it. If your usage shifts, you don’t eat the cost, we do. That means you can access long-term savings without being trapped by long-term obligations.

- You get the savings, without the stress We pass through AWS’s best pricing. But unlike traditional models, you only pay for what you use. There’s no guessing game. No overcommitment. No scrambling to offload unused commitments when the budget tightens.

- We’re aligned with AWS: Let’s be honest, many vendors built their models on grey-area tactics. They weren’t sustainable, and AWS is finally calling time on them. Our model is different. We help AWS drive real, durable commitments that match their infrastructure planning needs. That makes us a partner, not a workaround.

Importantly, Cloud Capital has never relied on reallocation, sub-account transfers, or pooling. Our model was purpose-built to comply with AWS’s intent, even before the June 1 rule change.

We’re not trying to work around AWS’s model - we’re strengthening it, while protecting you.

We’ve walked this path before

We built Cloud Capital after years of living this pain ourselves. We’ve been the startup finance leader trying to reconcile a cloud commitment spreadsheet with a growth forecast that changes monthly. We’ve been the engineer trying to explain to finance why we need to refactor a workload mid-commitment.

We know how misaligned this system has been. And we’re here to fix it. We’re not just trying to save companies money, we’re helping them build financial structures around cloud that actually make sense. Because when finance and engineering can collaborate on a cost structure that’s stable, transparent, and adaptable, everyone wins.

Why this matters more than ever

You already know what happens on June 1st. The rules change. The flexibility vanishes. And companies that haven’t prepared will be stuck holding long-term commitments with no exit and no upside. But here’s the good news: this shift isn’t just a threat. It’s an opportunity.

If you take action now, you can:

- Clean up your commitment structure

- Eliminate exposure you didn’t even realize you had

- Lock in pricing without locking up your flexibility

- And build a procurement strategy that won’t fall apart when AWS tightens the screws

That’s not just smart finance, it’s a strategic advantage.

What we’ve seen from the CFOs we work with

Some common themes emerge when we talk to finance leaders navigating this transition.

“We signed this commitment when our forecast was different.”

“We thought our vendor had it handled.”

“We assumed we could get out if we needed to.”

“We didn’t realize how exposed we were.”

This isn’t about pointing fingers. It’s about recognizing that the system was never built with finance in mind, and now, finance is expected to clean it up. That’s why we exist.

A new model for a new market

Let’s stop trying to bend outdated cost structures into a modern finance strategy. Let’s stop crossing our fingers and hoping that engineering usage aligns perfectly with multi-year AWS deals. Let’s stop asking CFOs to carry risk that should be absorbed, shared, and priced like any other financial asset. Cloud finance is growing up. It’s becoming too big, too complex, and too strategic to treat like a line item you "optimize" once a quarter.

At Cloud Capital, we’re here to help CFOs lead that change, not just react to it.

The old playbook won’t protect you. That’s why we built Cloud Capital: to give CFOs the savings they need without the risk they can’t afford. If you’re ready to rethink your approach to cloud finance, let’s talk. No pitch. Just clarity.

We’re already working with CFOs who’ve realized the old system won’t protect them. They’ve seen what’s coming. They’ve asked the hard questions. They’ve chosen to stop playing the game, and start building a strategy.

FAQs